The crypto funds are crypto currencies available for investors. These funds may either contain crypto currencies or other assets. They bring exponential outgrowth, outsized returns, ease of transactions and several other benefits. In this article, I explain you how crypto funds can help you.

In order to understand how crypto funds can help, you should first understand how they work.

About Crypto funds

The crypto funds consist of crypto currency and other assets. They are almost similar to the traditional portfolio investments. However, the only difference is that they are completely made of digital assets. The crypto funds are made of digital assets including the crypto currency and are managed by one or several individuals.

How crypto funds help

Outsized returns

The crypto funds have been the best performing assets for the last 13 years. They had no value when they entered the market. But today a fraction of penny on the crypto funds will rise to thousands of dollars.

Portfolio diversification

Today the crypto funds are called the non-correlated asset class. They are independent of other markets. Therefore, the factors that govern the stock market, commodities or the bonds do not have any impact on crypto funds.

Potential inflation hedge

The crypto funds are the best hedges against inflation. What does this mean? When inflation occurs, the government or central banks print more money. During such times, the value of things that are in high demand increases and vice versa. The crypto funds come with risk management strategies. Therefore, inflation has minimal or no effect on crypto funds. The crypto companies are shrewd enough to keep their currency demand high. They keep their crypto currencies scarce. Therefore, regardless of the monetary policies, the crypto always stands tall in the market.

Cross border payments

There are no borders for crypto currencies. An individual in one country can buy or sell crypto funds. There are no regulations, tensions, sanctions. For instance, if country X imposes sanctions on Y, X citizens cannot buy or sell anything from Y. Now this rule doesn’t apply to crypto currencies.

Inclusive financial system

The crypto funds are best suited for people who do not trust their own traditional financial system. Say a person lives in country A. He doesn’t like the financial policy launched against the funds. He thinks that the investing under such terms will bring him very few benefits. The crypto funds are best alternative to such people.

Secure Private transactions

Privacy and security are the biggest benefits of crypto funds. They use block chains to record the transactions.

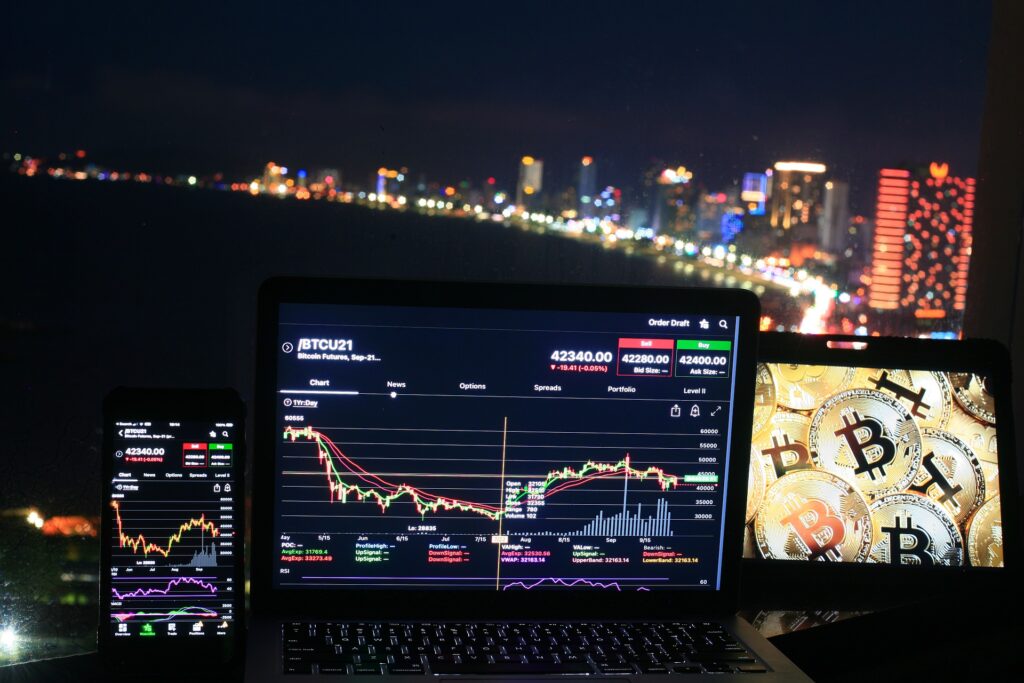

Markets are always open

The stock markets like New York Stock Exchange or NASDAQ open only during week days and during regular business hours, that is, between 9:30 AM and 4:30 AM. On the other hand, the crypto markets are open 24/7. So you can buy and sell crypto funds whenever you like.

Adaptability

The crypto companies take intensive measures to become resource-intensive. For instance, “The MERGE” that operated around Ethereum moved from Proof of Work model to Proof of Stake model. This was done to adapt to a much more efficient operating model.

I have given different ways in which the crypto funds can help. Hope my article was helpful!